A solution that provides your employees with the guidance and support they need right now

Are you looking for a way to help your employees help themselves?

Our financial education short course has been developed to help employers empower their employees with the right tools to overcome the financial challenges they’re faced with as a result of the devastating impact of COVID-19 on most people’s personal finances.

Employees receive a 45 min interactive course plus a downloadable Emergency Budget

The short course is designed to help everyone manage their short-to-medium term cash flow

This course will reduce financial anxiety by providing staff with a simple step-by-step plan

Your employees have the opportunity to work through the course material at their own pace

According to TransUnion’s Financial Hardship Study 80% of South African consumers indicated their household income has been impacted by COVID-19.

It’s statistics like this that highlight the need for financial education amongst your staff. The data below is also taken from TransUnion’s latest report.

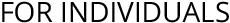

Are you concerned about your ability to pay your current bills and loans?

Give your employees their confidence back and increase productivity

Practical tools for your employees

- Confidence and skill to navigate any financial shock

- The ability to do an assessment of their baseline position

- How to effect a short-term contingency plan utilising a variety of tools including a downloadable emergency budget

Positive impact on your business

- Increase productivity and improve staff morale

- Decrease in staff turnover = reduced recruitment and training costs

- Valuable deployment of B-BBEE funds

Help your employees develop the financial resilience they need

From R499/employee

Chat to us.

Start the transformation.

Please use the Calendly diary here to book your free session.

Can’t see the calendar? Click here to book a time